To file your income tax return online, you must first register and log in to the Income Tax e-filing portal. Once you complete the Income Tax login process, you can access the portal and use a wide range of tax-related services.

The following information will help you navigate the login process on the Income Tax e-filing website.

Whether you're filing your Income Tax Return, checking your refund status, responding to tax notices, or reviewing your previous filings, everything is accessible in one secure place. The Income Tax e-filing portalserves as your personal tax dashboard, offering a simplified way to stay compliant and up to date.

Logging in is the first step in your tax journey. Once you log in, you get access to a host of personalized services - from viewing Form 26AS and AIS to downloading your ITR-V and filing updated returns. This is the starting point for every taxpayer who aims for timely, accurate and hassle-free income tax management.

Mandatory Details for Income Tax e-Filing Login

To log in to the Income Tax Department's website and handle your tax returns, you need a few important things ready. These items help make sure your login is easy, safe, and follows the rules.

Here’s what you need before logging in:

PAN (Permanent Account Number): This serves as your login ID on the e-filing portal. Every taxpayer, whether salaried, self-employed, or a business owner, must have a valid PAN to initiate the login process.

Mobile Number: This is how you'll get a special code, or OTP, to prove it's really you. It's for your security when you log in and when you need to sign off on your return.

Email Address: This is where the tax department sends all your official messages, updates, and alerts. It's also a lifesaver if you ever need to reset your password

Aadhaar Number: Your Aadhaar card has to be linked to your PAN card to file your taxes. You'll often use it to get an OTP as a quick way to verify your return.

By keeping these essentials ready, you’ll be able to log into the income tax portal without delay and smoothly access all services, from ITR filing to refund tracking.

How to register on the Income Tax Portal?

Follow the below steps to register on the portal:

Step 1: Visit the official website of Income Tax Department and select the "Register" option available on the homepage to start the registration process.

Step 2: You will need to select your user type, choose the appropriate option.

Step 3: Enter your basic details such as your name and date of birth.

Step 4: Provide your Email ID, Mobile Number, complete address and then click on 'Continue' button.

Step 5: Fill out the registration form with the following required information: a secure password, your contact details, current address, and a secret question for account recovery.

Step 6: Once the registration form is completed, the individual must verify their registration to proceed.

Step 7: Enter the 6-digit One Time Password (OTP) sent to your registered mobile number and email address.

Step 8: Confirm that all the details provided are accurate and correct.

Step 9: Click 'Register' and you will see a message confirming your successful registration.

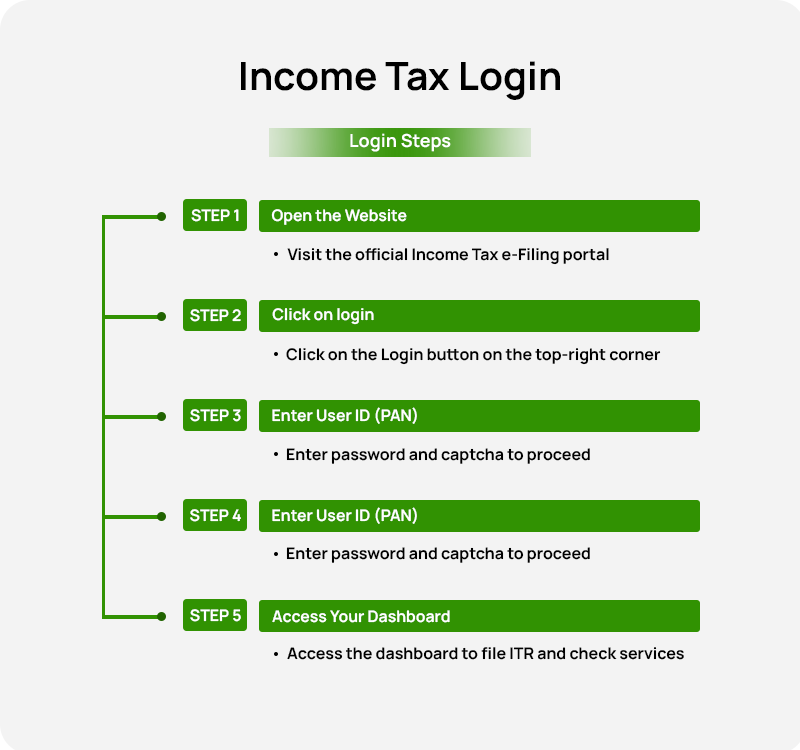

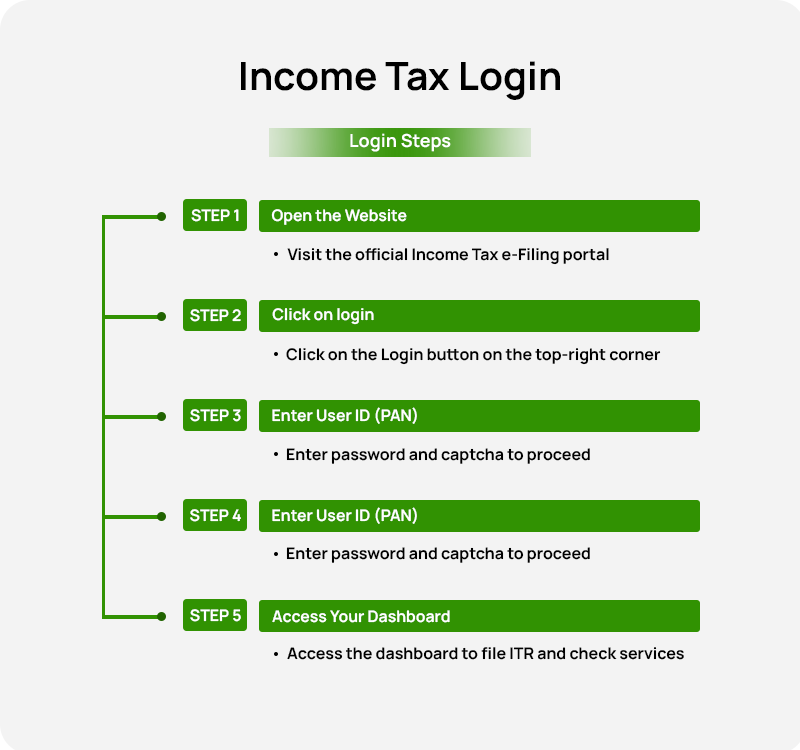

How to Log in on the Income Tax Portal?

Follow these steps to income tax login:

Step 1: Visit the official Income Tax e-filing portal.

Step 2 : Click on the 'Login' button on the homepage.

Step 3: Enter your income tax login user id (PAN number, Aadhar number, other user id) and continue.

Step 4: Click 'Continue' and then enter your password to confirm your secure access message.

How to Reset the Login Password of the Income Tax E-filing?

Here’s a guide to reset the income tax login password:

Step 1: Visit the the official website of the Income Tax e-filing portal.

Step 2: Enter PAN Number.

Step 3: Reset your password by selecting one of the following options:

OTP

Aadhaar OTP

Upload DSC

Answer secret question

Step 4: Enter the OTP or upload the file, then create your new password to complete the reset process.