Please Wait transaction is in process, don't refresh page and do not press back button.

After filing your Income Tax Return, verifying the ITR becomes mandatory. Without verification within the prescribed time limit the income tax return is not processed by the income tax department and is treated as invalid. E verification is the most convenient and widely used method as the entire process can be completed online within a few minutes. After successful verification a confirmation message is sent to the registered email address and the income tax return stands verified.

Go to www.incometax.gov.in/iec/foportal and sign in Income-tax Department of India for E-Verify your Income Tax Return (ITR)

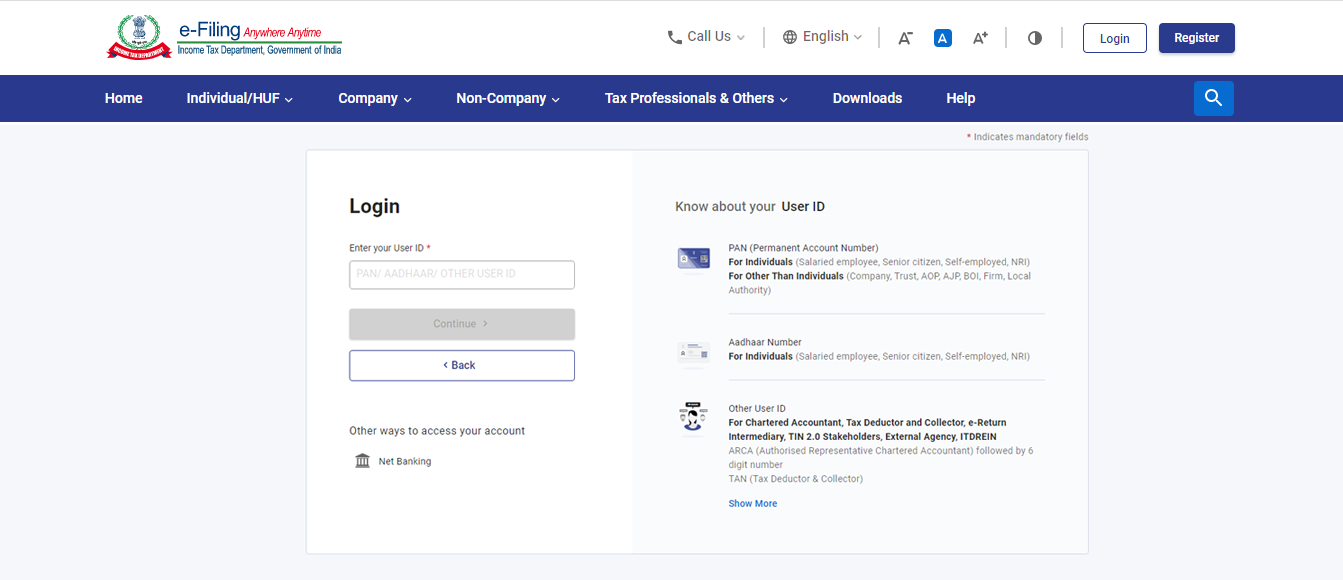

Click on Login You need to Enter Your User ID and Click On Continue Button for login.

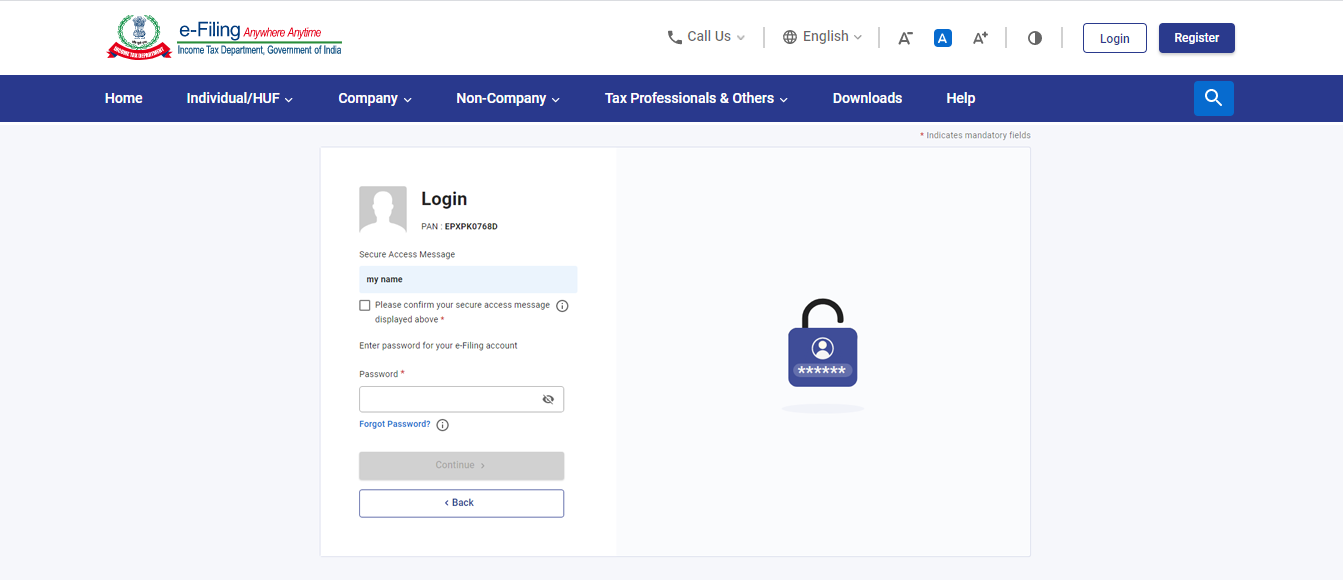

Click on continue Please enter Your Password here and click on continue to log in

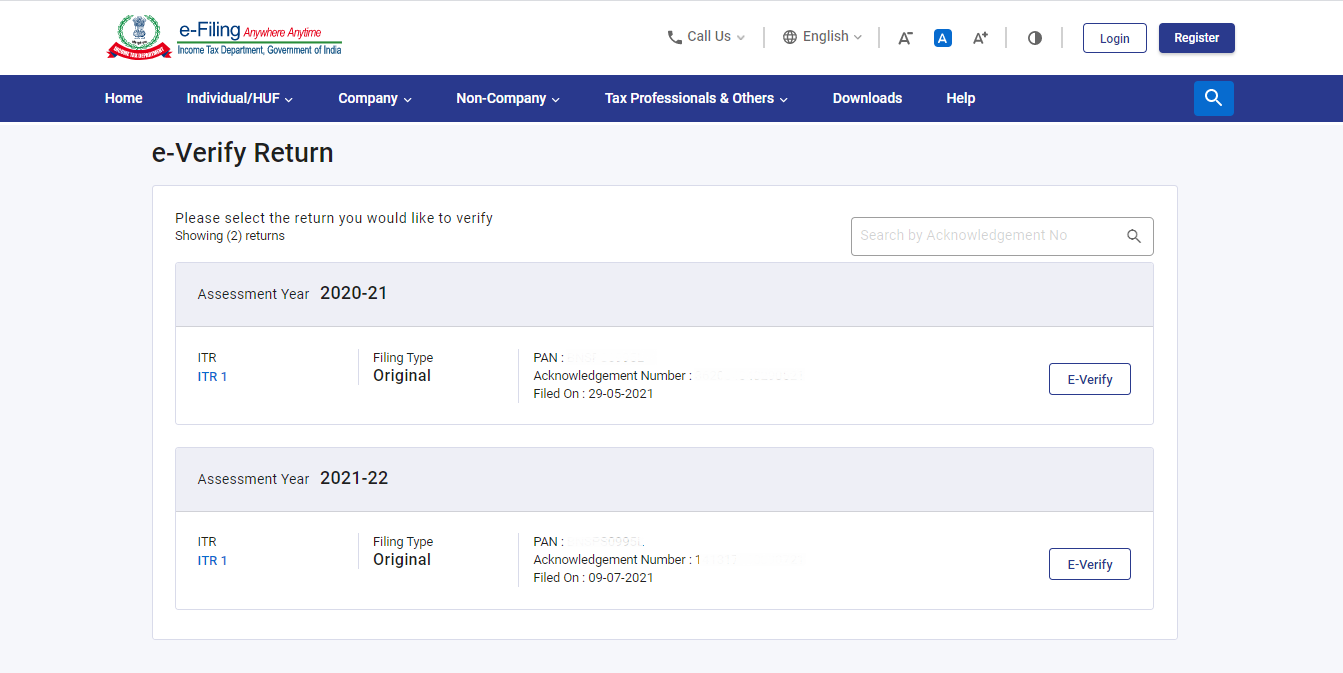

Click on the e-file option Click on e-file>>Income Tax Returns>>E-Verify Return

Now you Click on E-Verify

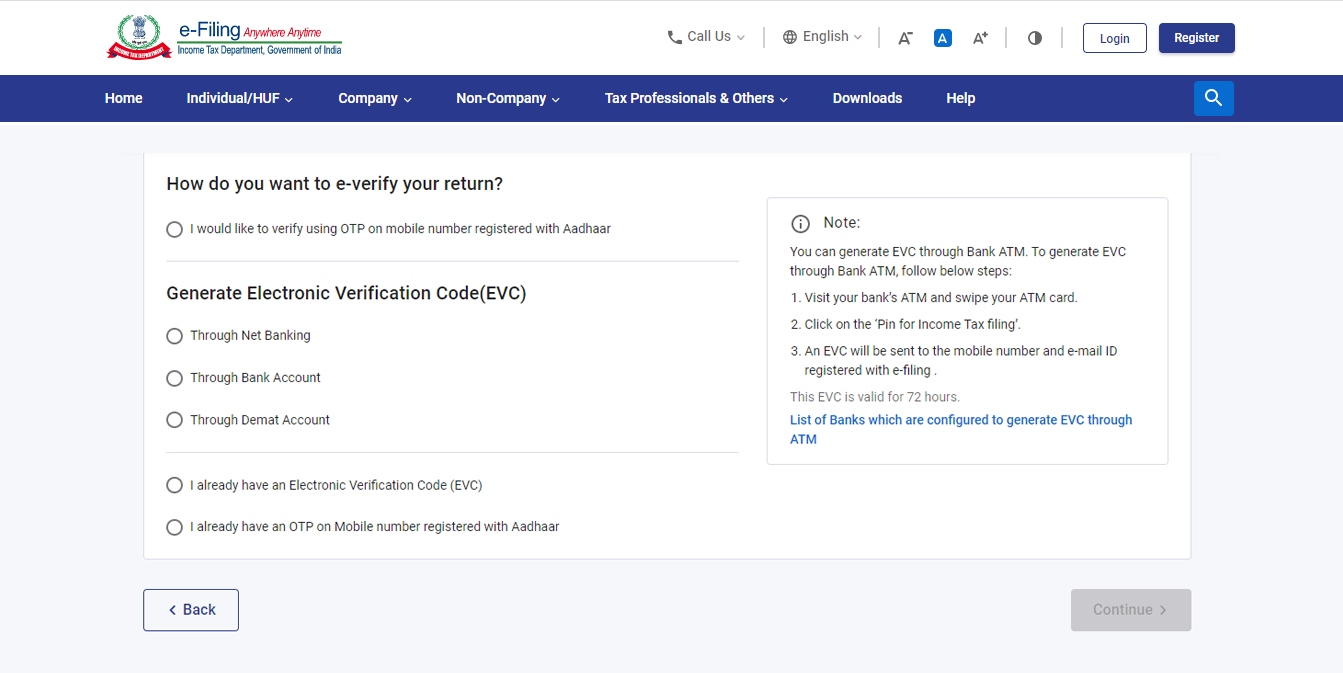

Here are the simple steps to e-verify your return using Aadhaar OTP:

Step 1: Log in to the official Income Tax e-filing portal.

Step 2: After logging in, Go to the e-File menu, select Income Tax Returns, and then choose e-Verify Return.

Step 3: From the list of filed returns, select the one that is pending for e-verification.

Step 4: Select the option to e-verify using Aadhaar OTP.

Step 5: Agree to the declaration, then click to generate the Aadhaar OTP.

Step 6: Enter the 6-digit OTP you receive on your registered mobile. Once validated, a confirmation appears on screen, and an acknowledgment email reaches your registered email address. Your ITR is now successfully verified.

Here are the simple steps to e-verify your return using Aadhaar OTP:

Step 1: Choose the ‘Through Net Banking’ option and Then, click on ‘Continue’.

Step 2: Select your bank and click on 'Continue’.

Step 3: Read the disclaimer carefully, accept it, and click Continue.

Step 4: Now you will be redirected to your bank's net banking login page.

Step 5: Click on the link to log in to e-Filing from your bank's website.

Step 6: After successful login, you will find yourself on the e-Filing Dashboard. Go to the ‘ITR’ option and click on ‘e-Verify’ button. With this, your ITR will be successfully e-verified. A confirmation message will appear on screen and an email will be sent to your registered address.

You can e-verify your Income Tax Return using your pre-validated bank account. This method generates an Electronic Verification Code (EVC) sent to your registered mobile and email.

Step 1: Make sure your bank account is pre-validated on the e-filing portal.

Step 2: On the e-Verify page, select the option ‘Through Bank Account’ and click Continue.

Step 3: Enter the EVC received on your mobile number and email ID registered with your bank account and click on the ‘e-verify’ button.

Here are the simple steps to E-verify your ITR through Demat Account

Step 1: Select the option ‘Through Demat Account’ on the e-Verify page and click Continue.

Step 2: Enter Electronic Verification Code (EVC) received and click on the ‘e-Verify’ button.

Verifying your Income Tax Return (ITR) is a mandatory step after filing. Here’s why you must complete it:

Without verification, your ITR is treated as invalid, even if you filed it before the due date.

The Income Tax Department processes your return and starts any assessment only after successful verification.

You will not receive your income tax refund until the ITR is verified. Delaying verification directly delays your refund.

If you fail to verify within the prescribed time limit (usually 30 days from filing), your return becomes invalid. You then have to file a belated return (if within the belated filing window), which attracts a late filing fee under Section 234F and possible interest on any tax due.

Yes! Verification of return is important to complete the return filing process.

ITR verification is the process by which a filed income tax return is confirmed. If you do not verify your ITR within the specified time limit, the return becomes invalid. In such a case, you will have to file a belated return, which will also attract a prescribed late filing fee.

If you fail to e-verify your ITR within the specified time, it will be treated as an invalid submission. You can receive a notice from the Income Tax Department asking you to complete the required verification.

The ITR must be verified within 30 days from the date of filing to be treated as a valid return.

Form 16 is not compulsory for filing an income tax return. Even without Form 16, an ITR can be filed using documents like salary slips, bank statements, Form 26AS, and the Annual Information Statement.

No, the ITR becomes invalid if not verified within the deadline.