Filing Income Tax Returns (ITR) is not just a legal obligation for salaried individuals in India—it’s also a smart financial habit. Every year, lakhs of salaried taxpayers file their returns to report income, claim deductions, and ensure compliance with the Income Tax Act.

If you’re a salaried employee wondering how to file your ITR smoothly and correctly, this guide will walk you through every essential detail—from choosing the right ITR form to verifying your return.

Documents Required for ITR Filing for Salaried Employees

To file your income tax return smoothly, it is important to gather all necessary documents that reflect your income, deductions, and exemptions. If you are a salaried individual, Form 16 issued by your employer is typically the key document. However, if Form 16 is unavailable, you can still calculate your income using alternative records such as salary slips, bank statements, and details of investments.

For tax deducted at source (TDS) or tax collected at source (TCS), you can refer to Form 26AS, which provides a comprehensive summary. This document is easily accessible through the TRACES platform on the Income Tax Portal. Additionally, keep documents like Form 16A (for non-salary income), exemption proofs for Section 80D (health insurance premiums) or Section 80U (disability-related benefits), and statements for capital gains ready, if applicable. Having all these records in place ensures a hassle-free and accurate tax filing experience.

How to File Income Tax Return Online for Salaried Employees with Web Online CA?

Follow these easy steps to file your Income Tax Return (ITR) online for salaried employees with Web Online CA. Ensure a smooth and hassle-free filing process by completing each step accurately.

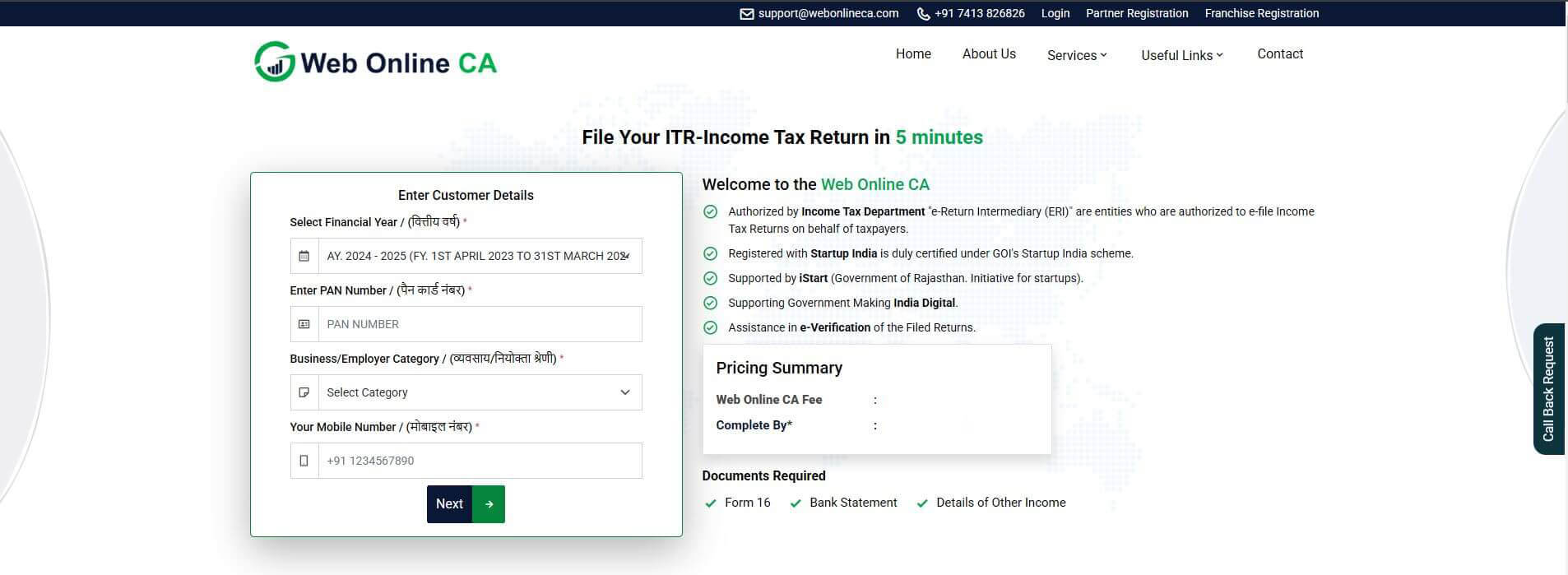

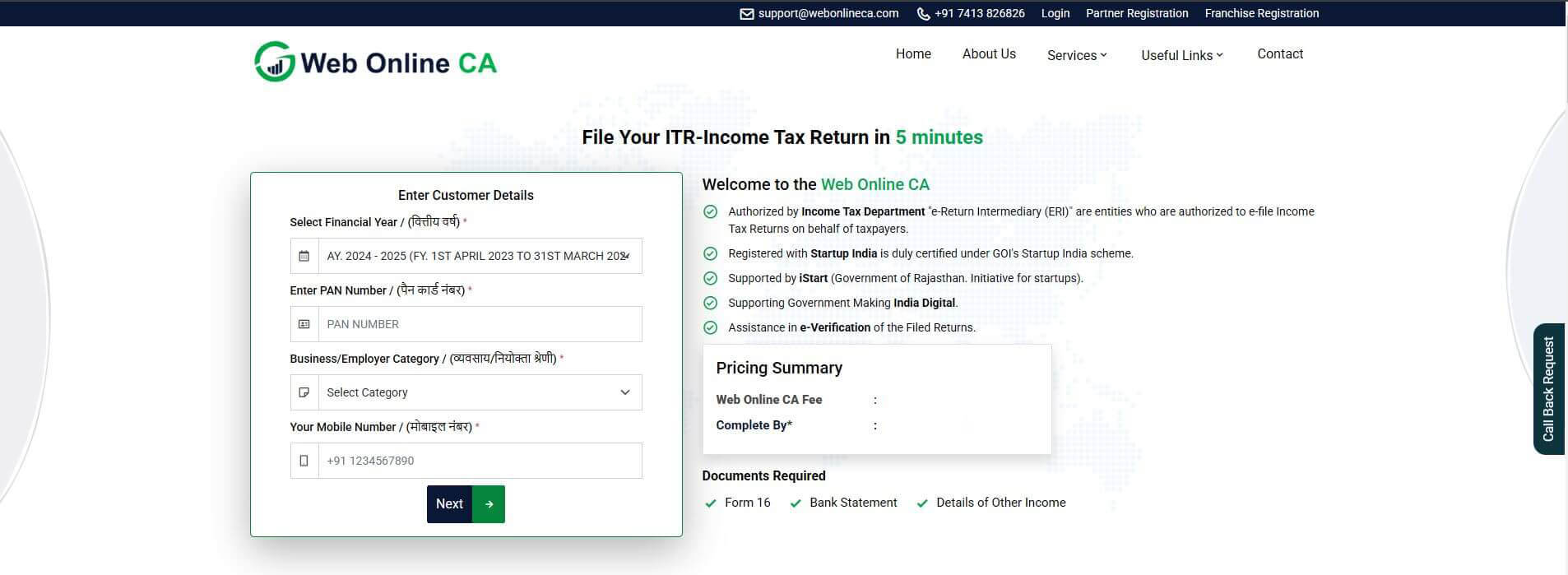

Step 1: Sign Up: Start by signing in to your Web Online CA account. If you're new to the platform, you can quickly create a new account by entering your you mobile number. Once you're signed in, you’ll have access to the self-filing option, making it easy to file your ITR if your income includes salary, business, or capital gains.

Step 2: Customer Details: After signing in, the next step is to enter your personal details. This includes providing information such as financial year, PAN number, business/employer category and contact details. Make sure to double-check the accuracy of the information you enter, as this will be used for processing your tax return. Once your details are submitted, you can move on to the next step in the filing process.

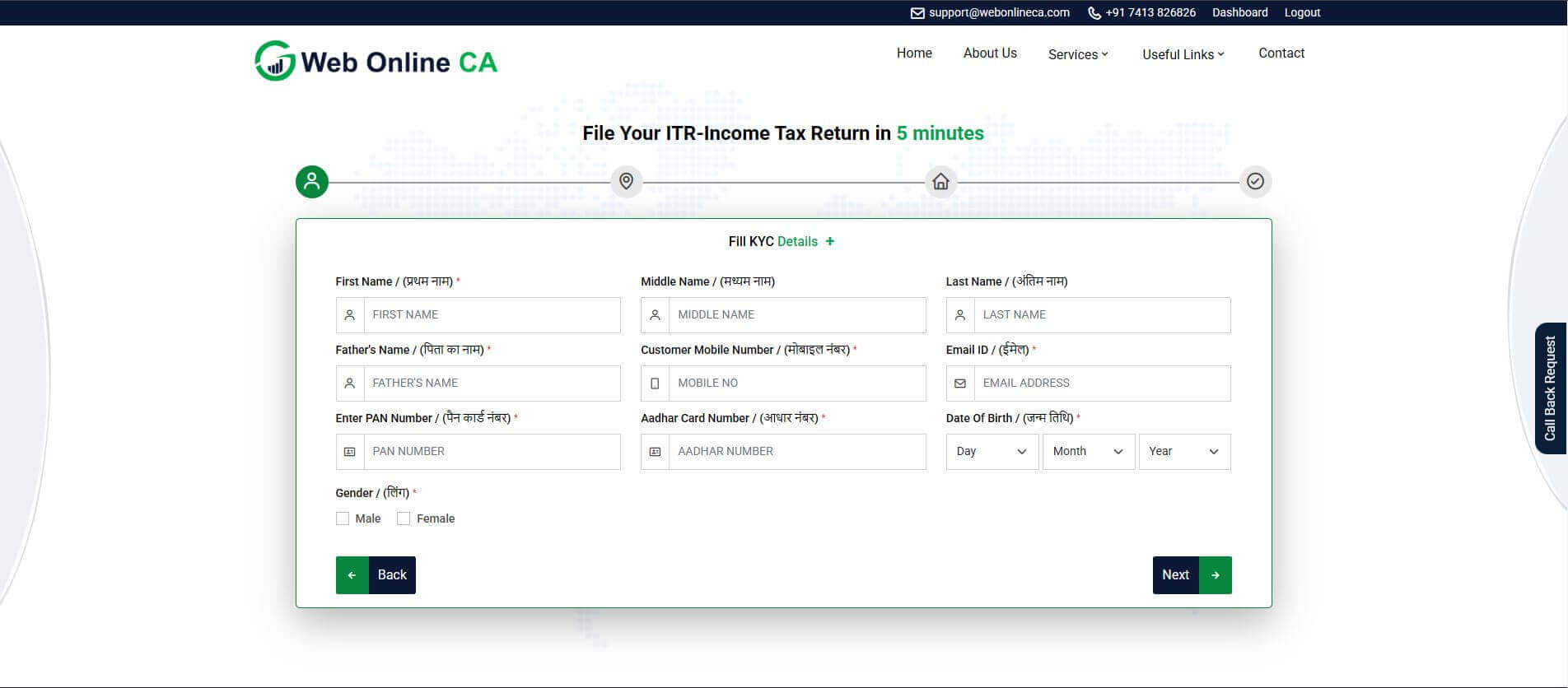

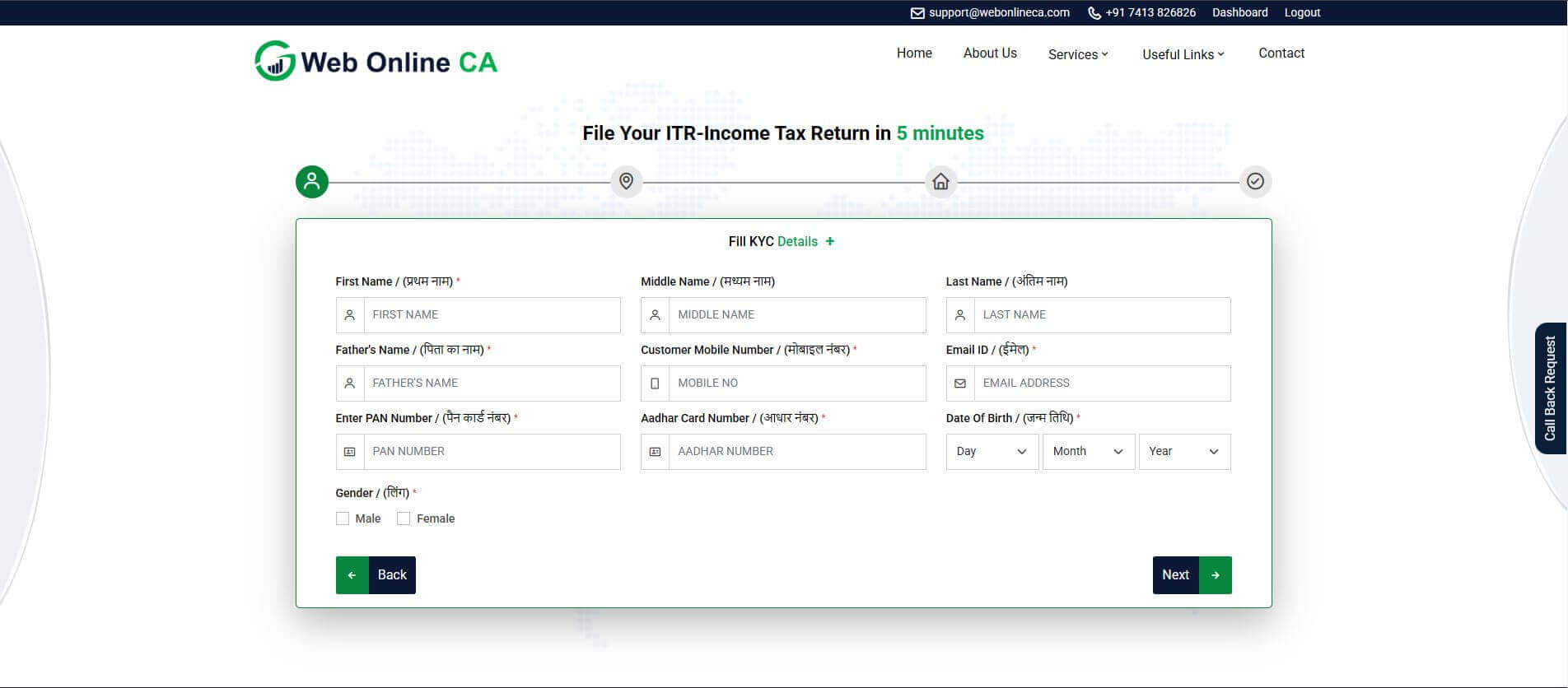

Step 3: KYC Details: The next step is to enter your Know Your Customer (KYC) details. This involves providing your name, email, date of birth and other necessary identification information to verify your identity. Ensure that all the information you provide is accurate and up-to-date to avoid any issues with the filing process. Once your KYC details are successfully entered, you can proceed to the next stage of your income tax return filing.

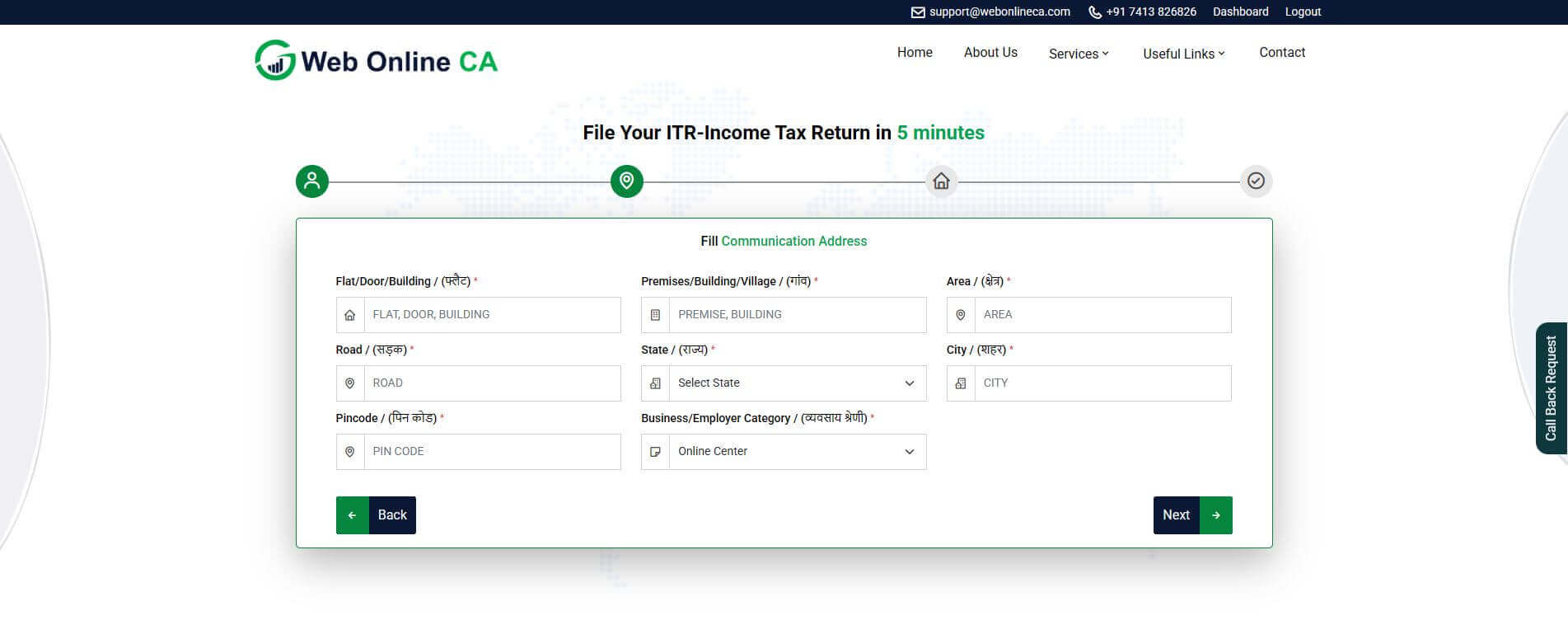

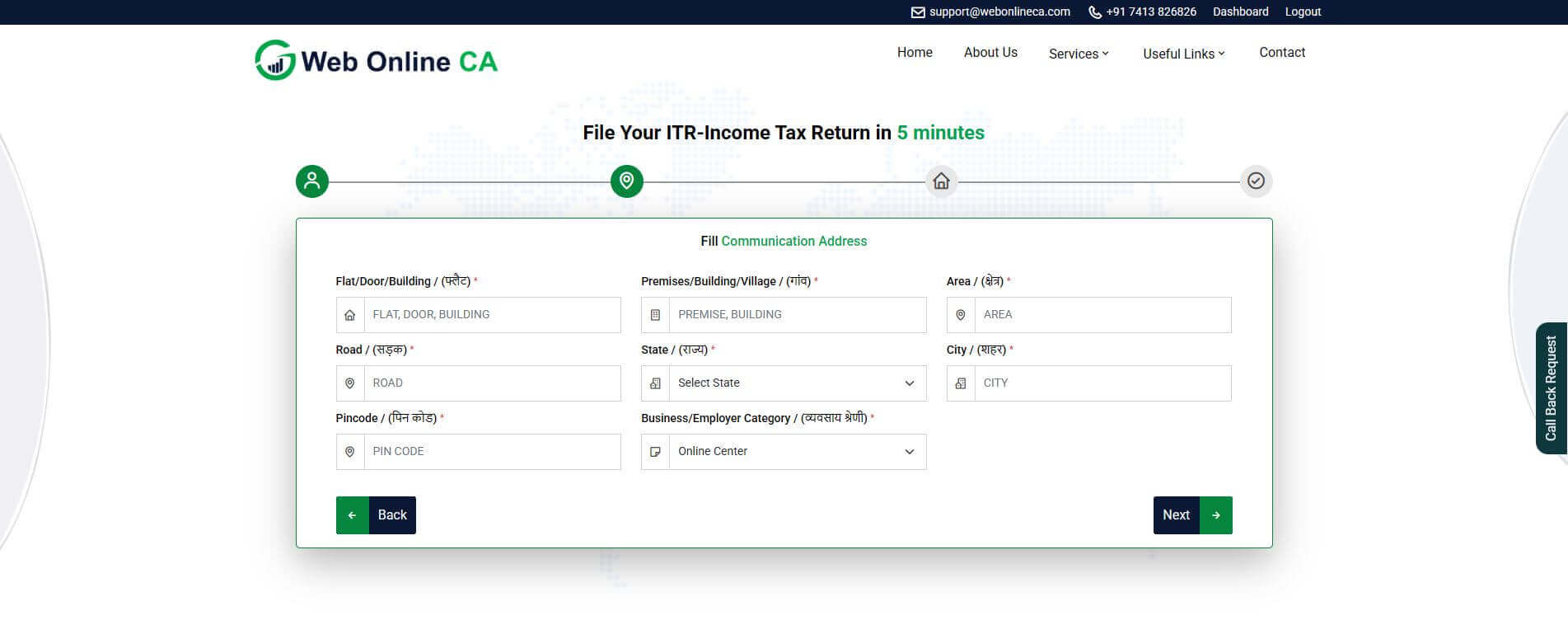

Step 4: Communication Address: The next step is to provide your communication address. This is the address where all future correspondence regarding your tax filing will be sent. Make sure to enter your correct and current address, including details like area, city, state, and PIN code. Double-check the information for accuracy to ensure you receive any important updates or notices from the tax department. Once your communication address is entered, you can move on to the next step.

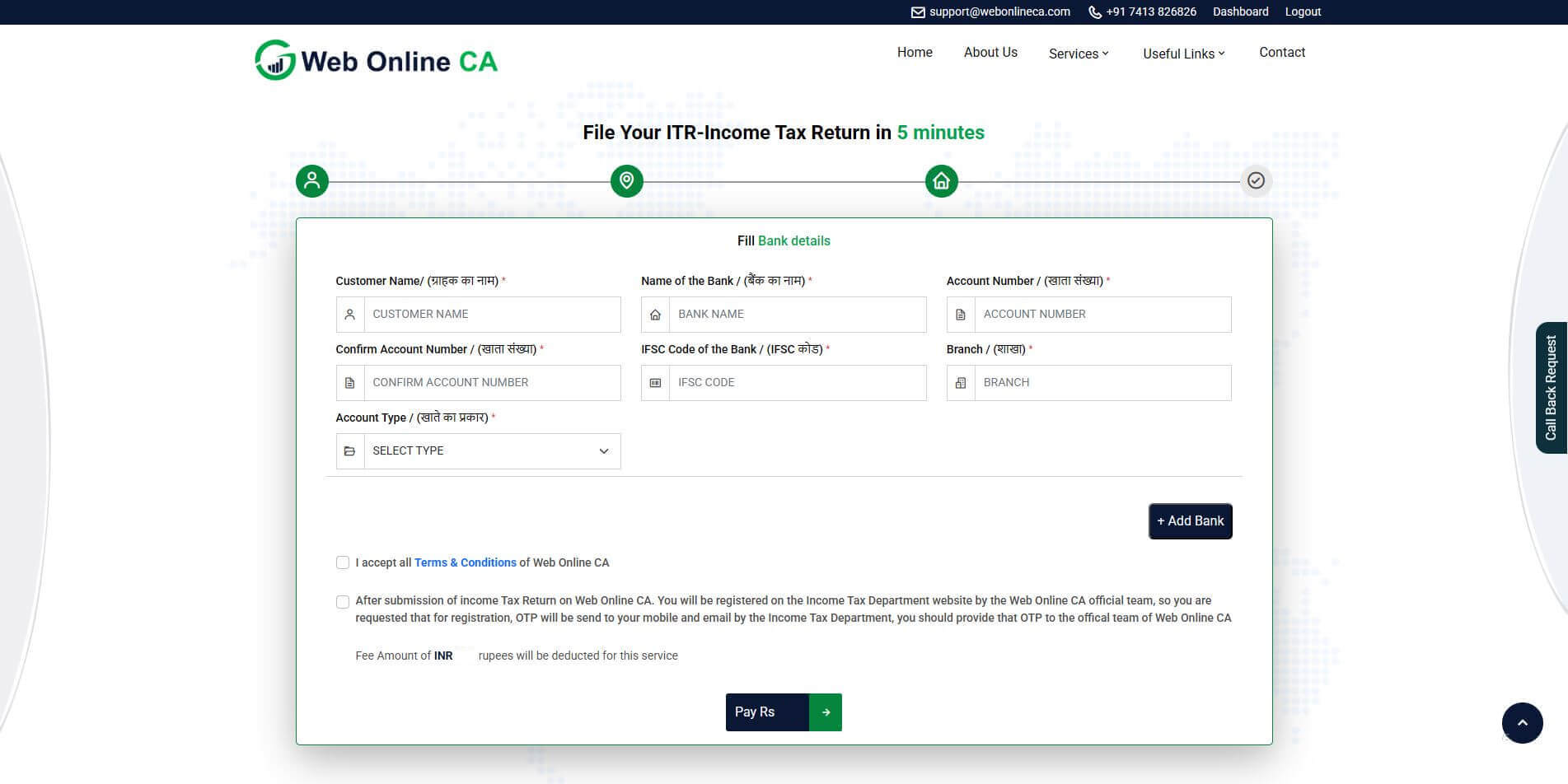

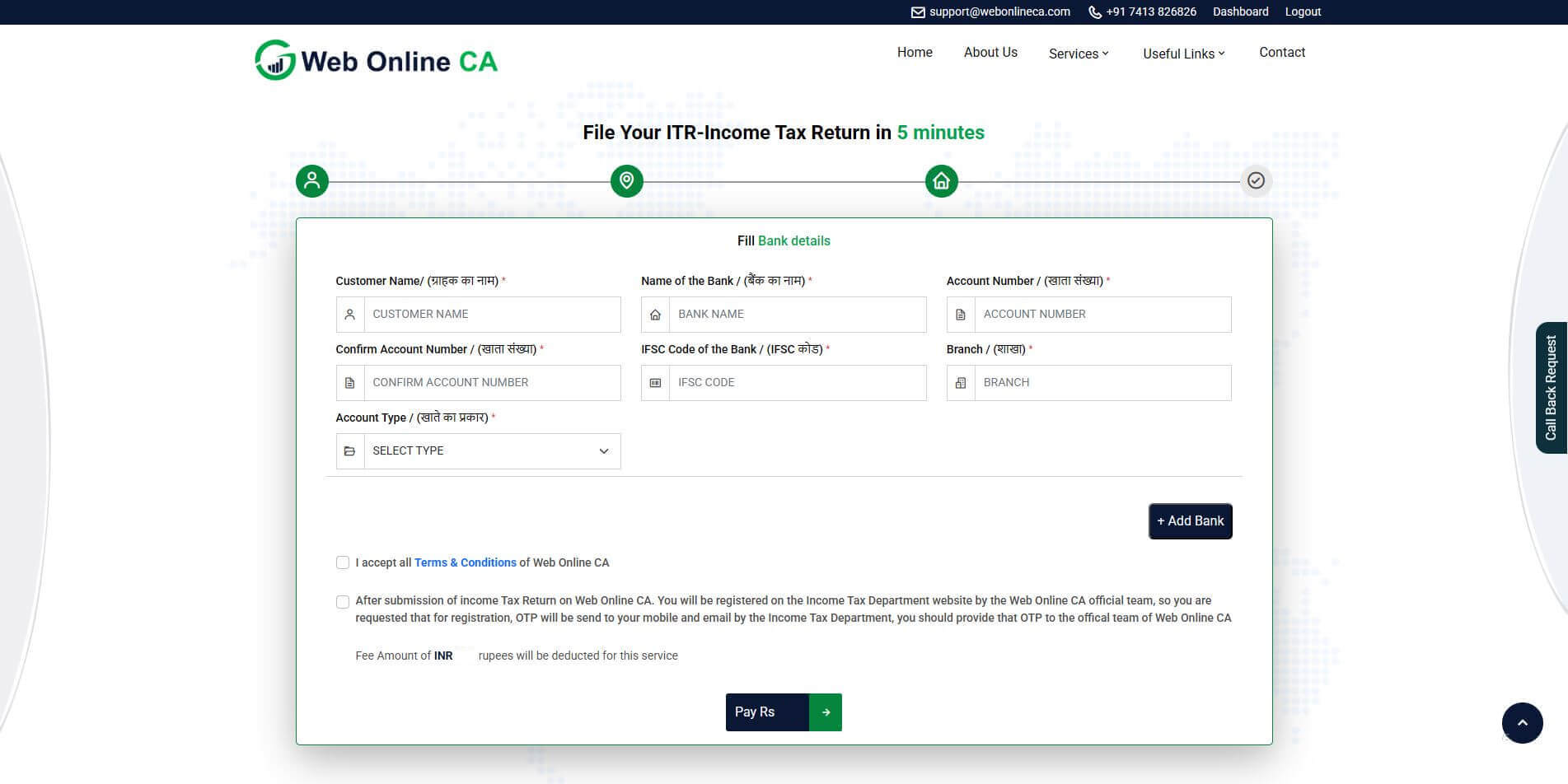

Step 5: Bank Details: The next step is to enter your bank account details. This is important for receiving any tax refunds directly into your account. Provide accurate details, including your bank name, account number, IFSC code, and account type (savings or current). Double-check the information to avoid any errors that could delay your refund. Once your bank details are entered correctly, you can proceed to the next step in the income tax return filing process.

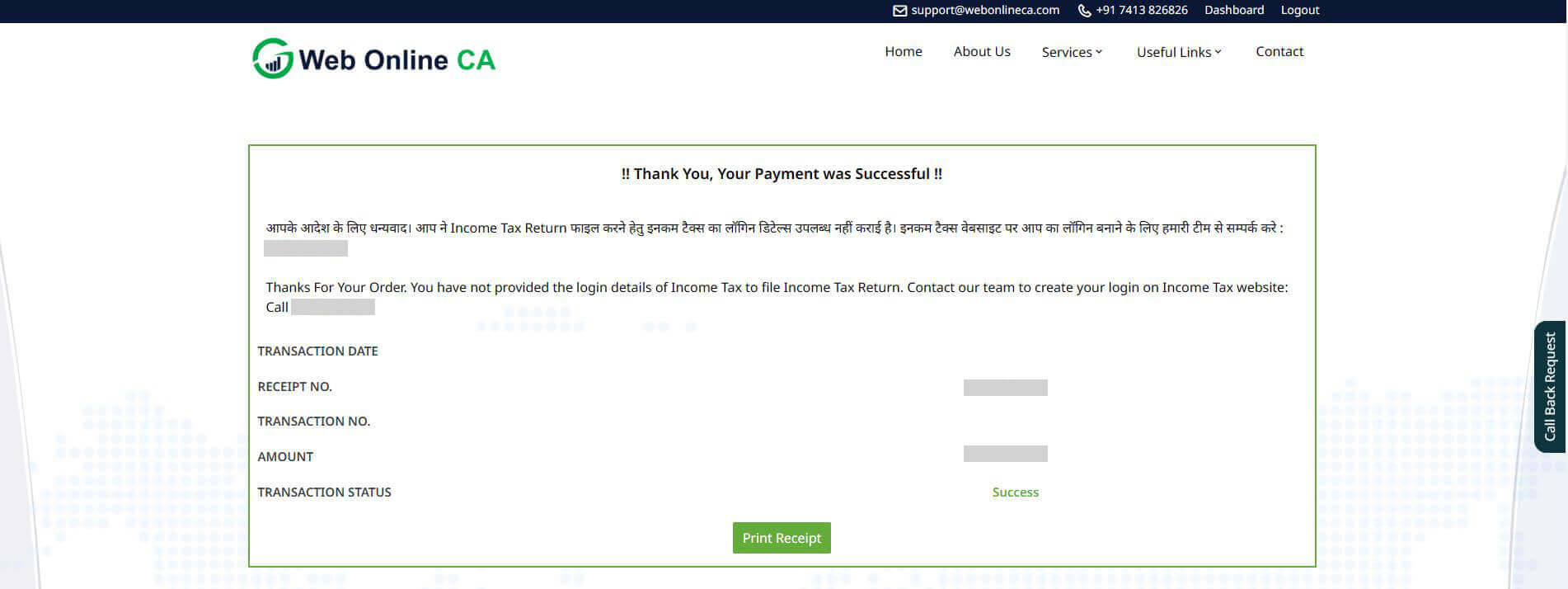

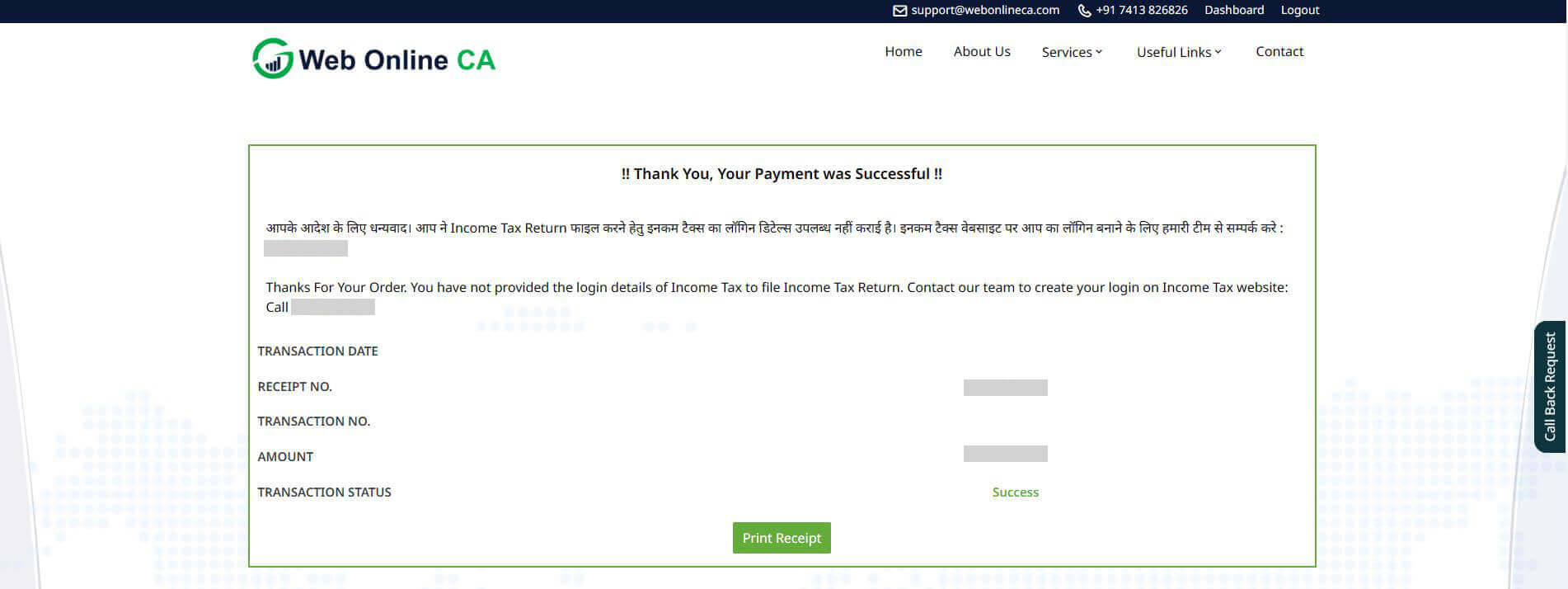

Step 6: Make Payment: Once all your details are entered, the next step is to make the payment for the tax filing process. You can pay the applicable fees through various payment methods, such as credit/debit cards, net banking, or other online payment options. After completing the payment, ensure that you receive a confirmation receipt. This will confirm that your payment has been successfully processed.

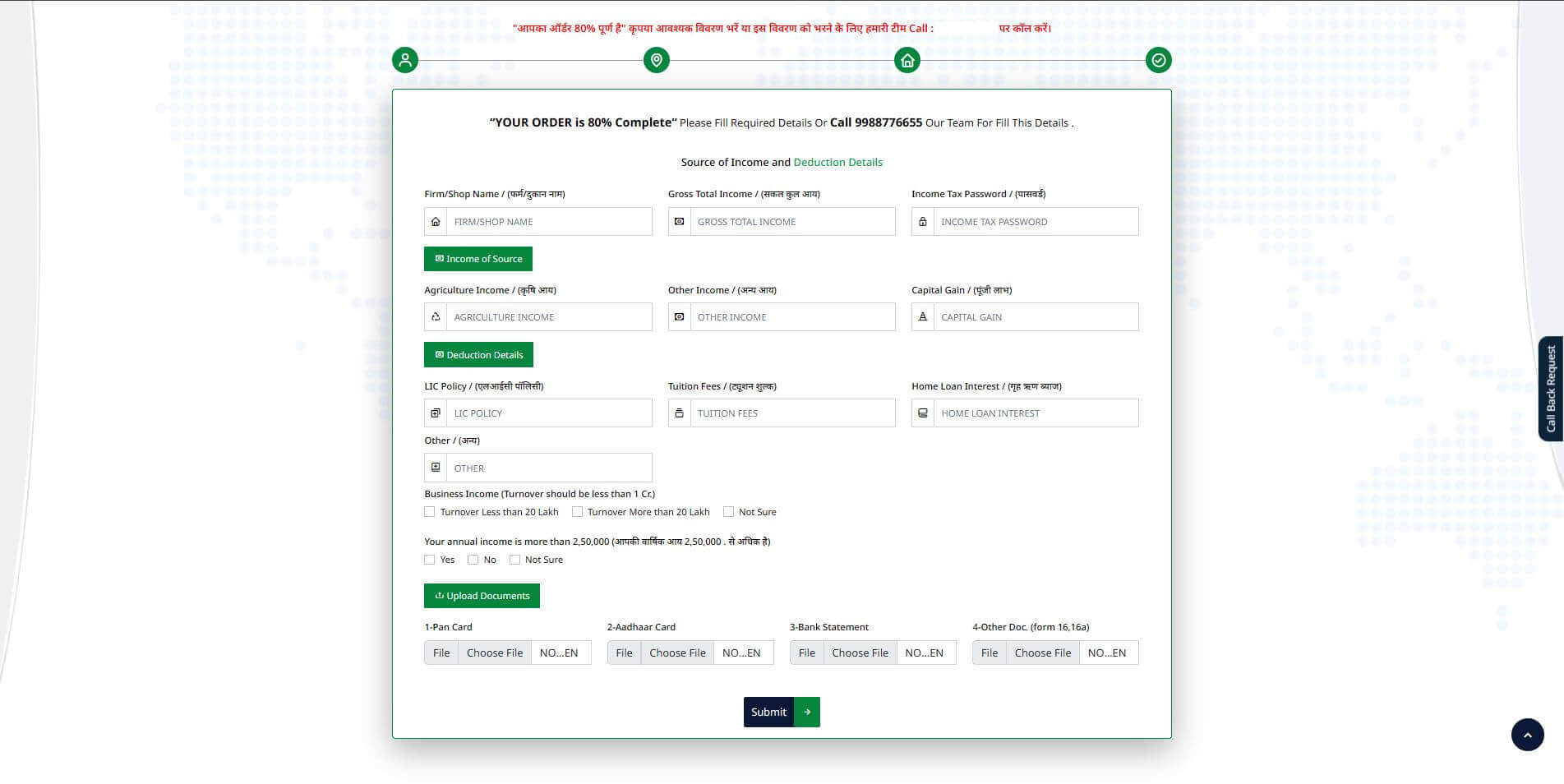

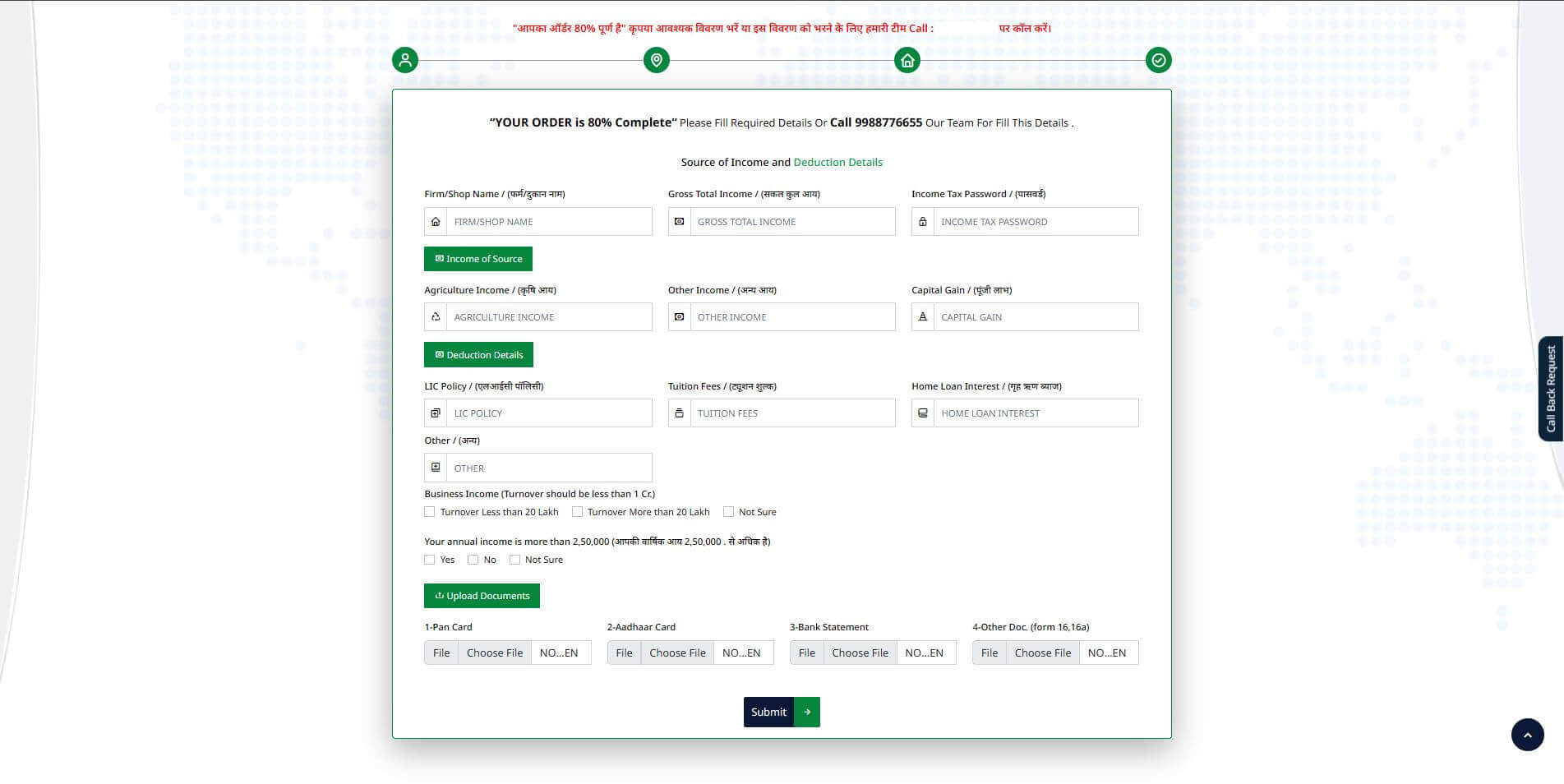

Step 7: Income and Deduction Details: In this step, you'll need to provide details about your income sources and applicable deductions. This includes entering information about your salary, business income, capital gains, or any other income sources. Ensure that you accurately fill in these details to maximize your tax benefits and avoid any errors.

Why Should Salaried Individuals File Income Tax Returns?

Salaried individuals should file income tax returns (ITR) for several important reasons:

Claim Refunds: If tax is deducted at source (TDS) from your salary and it exceeds your actual tax liability, filing an ITR allows you to claim a refund.

Legal Requirement: If your income exceeds the taxable limit set by the government, filing an ITR becomes a legal obligation. It helps ensure compliance with tax laws and avoids penalties or legal consequences.

Loan and Visa Applications: A filed ITR is often required when applying for loans (home, car, or personal) or for visas, as it acts as proof of income and financial stability.

Carry Forward Losses: In cases where you have capital gains or business losses, filing ITR helps you carry forward those losses to future years, which can be used to offset against future income.

Filing your ITR ensures transparency, helps manage your finances effectively, and contributes to a smoother interaction with financial institutions and the government.

FAQ's

1. How do I calculate my taxable income as a salaried employee?

Your taxable income is the total of your salary after considering deductions like Provident Fund (PF), HRA, and other exemptions. Subtracting these from your gross salary gives you the taxable income, which is then used to calculate your tax liability.

2. Can I claim deductions under Section 80C as a salaried employee?

Yes, salaried employees can claim deductions under Section 80C, which includes contributions to Provident Fund (PF), Life Insurance Premium, PPF, and other eligible investments, helping reduce your taxable income and the overall tax liability.

3. Do I need to file ITR if my salary is below the taxable limit?

Even if your salary is below the taxable limit, it is still a good idea to file your ITR. Filing ensures you stay compliant with the law, and it helps in situations like applying for loans or visas.

4. Can I file ITR without Form 16?

Yes, you can file ITR without Form 16, but you will need to provide other supporting documents like your salary slips, bank statements, and details of tax deductions. Form 16 is a helpful document, but not mandatory if you have all the other relevant details.

5. What happens if I don’t file my ITR on time as a salaried employee?

Failing to file ITR on time can lead to penalties, interest on unpaid tax, and possibly scrutiny from the Income Tax Department. It's always better to file your return on time to avoid unnecessary complications and maintain a clean financial record.