Form 16 is an important document for salaried employees in India. This document is issued to employees by the employer. It contains their annual income, tax deducted at source (TDS), and other tax-related details. Form 16 plays a vital role in filing income tax returns for employees as it helps them to correctly present their income and tax liability. Form 16 is a document that shows that you have paid your taxes to the government.

In this guide, you will learn what Form 16 is, why it is important, and how it helps you file your income tax returns.

What is Form 16?

Form 16 is a document that is issued by the employer to the employees. It includes complete details of salary received, tax deducted (TDS) and tax deposited to the government during that financial year. Form 16 acts as the most important proof at the time of filing Income Tax Returns (ITR). It makes the ITR filing process simple and quick as it contains the complete details of salary structure, allowances, deductions and tax paid.

Every year, after the end of the financial year, the employer has to give Form 16 to his employees by 15 June of the next assessment year. For example, Form 16 for the financial year 2024-25 should be issued by 15 June 2025.

Types of Form 16

Form 16 is mainly of two types, called Form 16A and Form 16B. Their types are as follows:

Form 16A: Form 16A is a TDS certificate which is issued on income other than salary. This means that if your income is from interest, commission, rent or any other source and TDS has been deducted on it, then you get Form 16A.

Form 16B: Form 16B is issued in case you buy a property and its price is more than ₹ 50 lakh. In such a case, the buyer has to deduct TDS and deposit it to the government and then Form 16B is issued. It contains the information of both the buyer and the seller and the details of the TDS deducted.

Components of Form 16

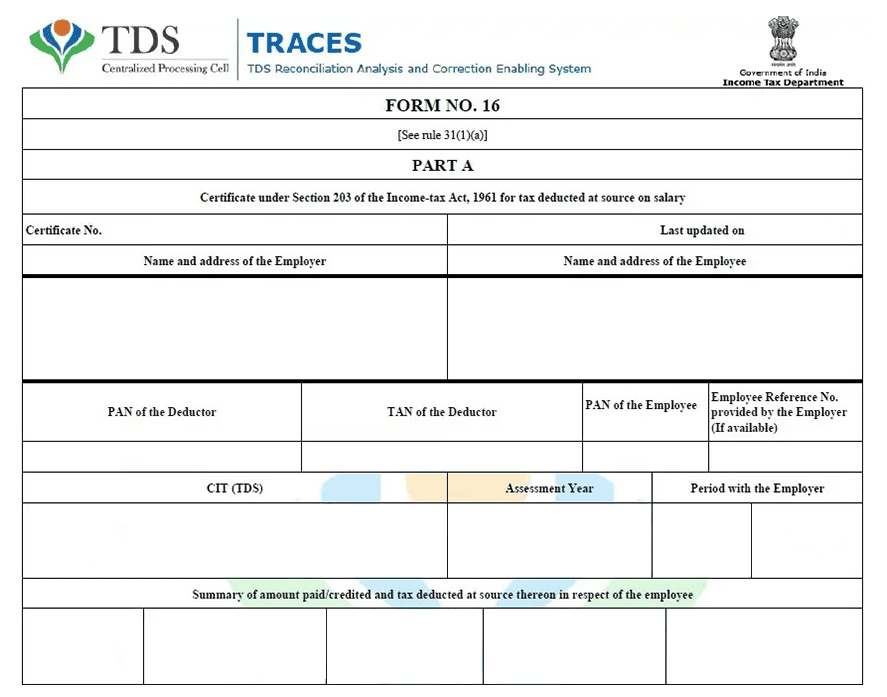

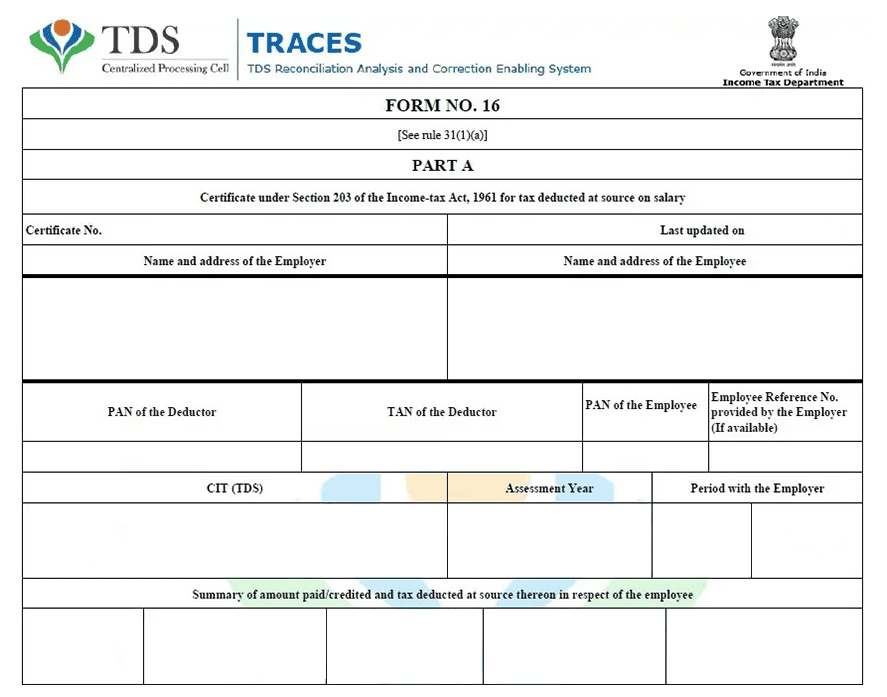

Form 16 is an important document in the Income Tax Department and is mainly divided into two parts: Part A and Part B. Each part is useful for different purposes.

Part A:

• It contains information about the TDS deducted by the employer.

• It contains information like name, address, PAN and TAN of both the employer and the employee.

• It tells how much tax was deducted and deposited to the government in a year.

• If you change jobs, every employer will give you Form 16 Part A separately.

Part B:

• It gives the complete details of your salary.

• It contains the breakup information of your salary like – basic salary, HRA, allowances, bonus, pension contribution etc.

• Apart from this, it contains complete details of your investments, deductions (like section 80C, 80D etc.), and tax liability.

• It gives the summary of your income and clarifies the tax calculation.

Why Do You Need Form 16?

Form 16 is a very important document for employees filing income tax returns. It gives details of the income you earned and the tax deducted during the year, and also makes tax-related processes easier for you.

• It is an official certificate of income and tax deduction.

• This document is considered most important while filing ITR.

• If any kind of verification is done by the tax department, then Form 16 acts as a proof for you.

• It is also considered an important document for bank loans or financial transactions.

Form 16 Password

When employers send Form 16 to their employees in email or PDF format, this file is often password-protected. Its purpose is to keep your tax information and personal details safe and you need a password to open it. Usually the Form 16 PDF password is generated from the combination of your PAN number and Date of Birth.

For example, if your PAN is ABCDE1234F and Date of Birth is 15/07/1996, then the PDF password will be: ABCDE15071196.

Eligibility for Form 16

Every salaried employee from whose salary TDS has been deducted is eligible to receive Form 16. However, if an employee's income falls within the tax-exempt limit and TDS has not been deducted on it, it is not mandatory for the employer to issue Form 16. However, many companies issue it to employees to show a complete summary of their total income and tax details, making it helpful in financial and other official work as well.

Eligibility:

• Salaried employees whose salary is deducted from TDS.

• Employees, whether within or outside the tax-exempt limit, are eligible for Form 16 if TDS has been deducted.

• If an employee's income is within the tax-exempt limit and TDS has not been deducted, Form 16 is not mandatory.

• Many companies issue it to employees to show a complete summary of salary and tax.

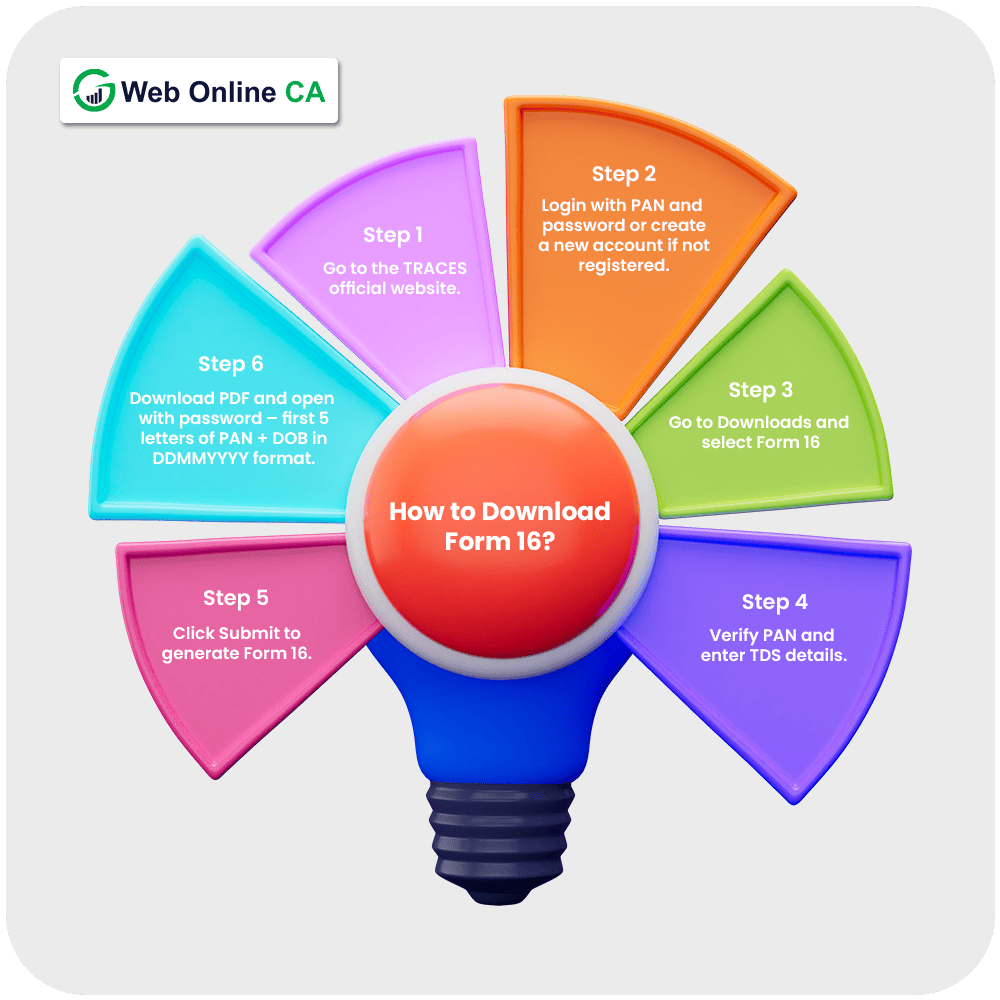

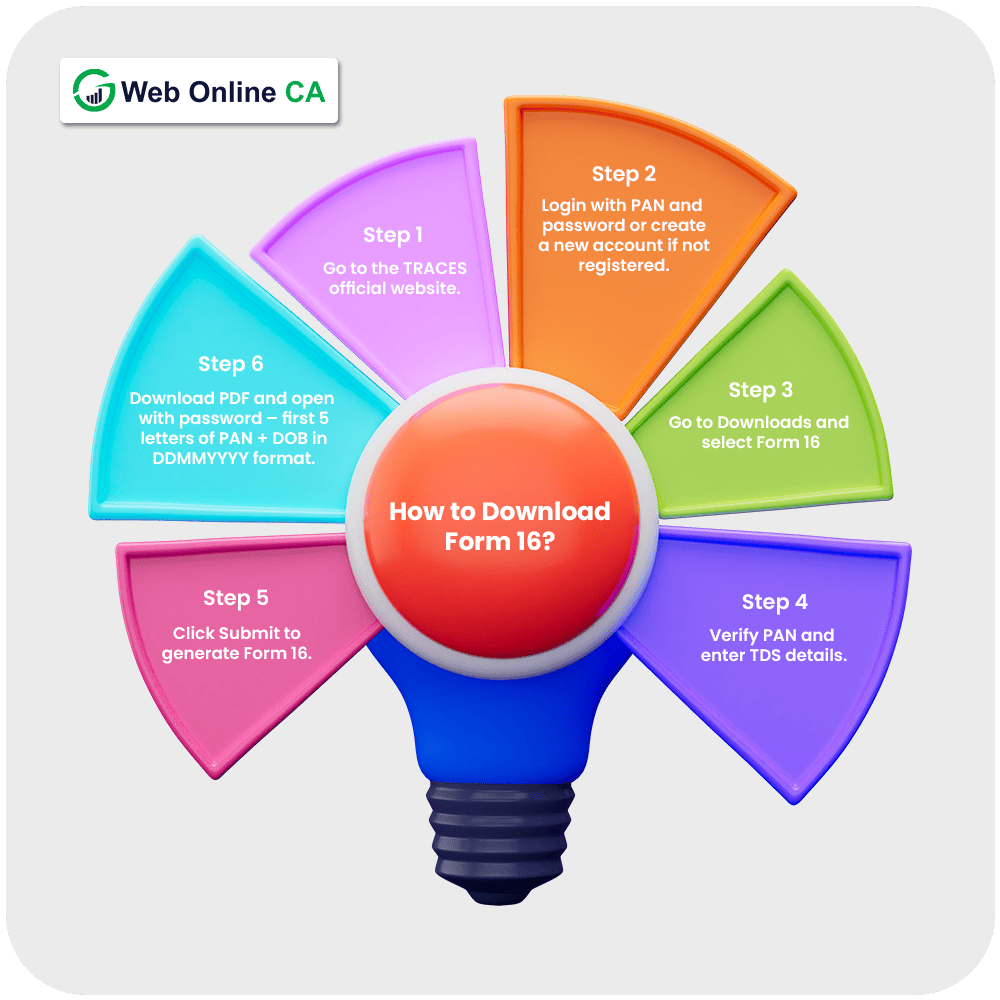

How to Download Form 16?

To download Form 16, visit the TRACES portal and follow the steps given below:

Step 1: Go to the TRACES official website.

Step 2: Login by entering PAN (User ID) and password. New users should first create their account.

Step 3: After successfully login, go to Downloads section and select Form 16 option.

Step 4: Now select the type of form and financial year for which Form 16 is required.

Step 5: Verify that your PAN and other details are correct.

Step 6: Enter TDS related information, such as TDS receipt number.

Step 7: Enter the total tax deducted and collected.

Step 8: Click on Submit to download Form 16.

Step 9: Once Form 16 is ready, go to the Downloads section and download the PDF file.

Step 10: After downloading the PDF open it using password write first 5 characters of your PAN in capital letters followed by your date of birth in DDMMYYYY format

Differences Between Form 16 and Form 16A

| Feature |

Form 16 |

Form 16A |

| Applicable to |

Salaried employees |

Self-employed, professionals, and individuals receiving non-salary income |

| Purpose |

Provides TDS details on salary income |

Provides TDS details on non-salary income |

| Who issues it? |

Individuals & HUFs |

Salary, Business/Profession, Capital Gains, House Property, Other Sources |

| Applicable Income |

Salary |

Interest, commission, rent, professional fees, etc. |

| Mandatory for ITR Filing? |

Yes, for salaried employees |

Required if TDS is deducted on non-salary income |

| TDS Deposited With |

Government on behalf of the employee |

Government on behalf of the taxpayer |

| Available Online? |

Yes, through TRACES and employer |

Yes, through TRACES and deductor |