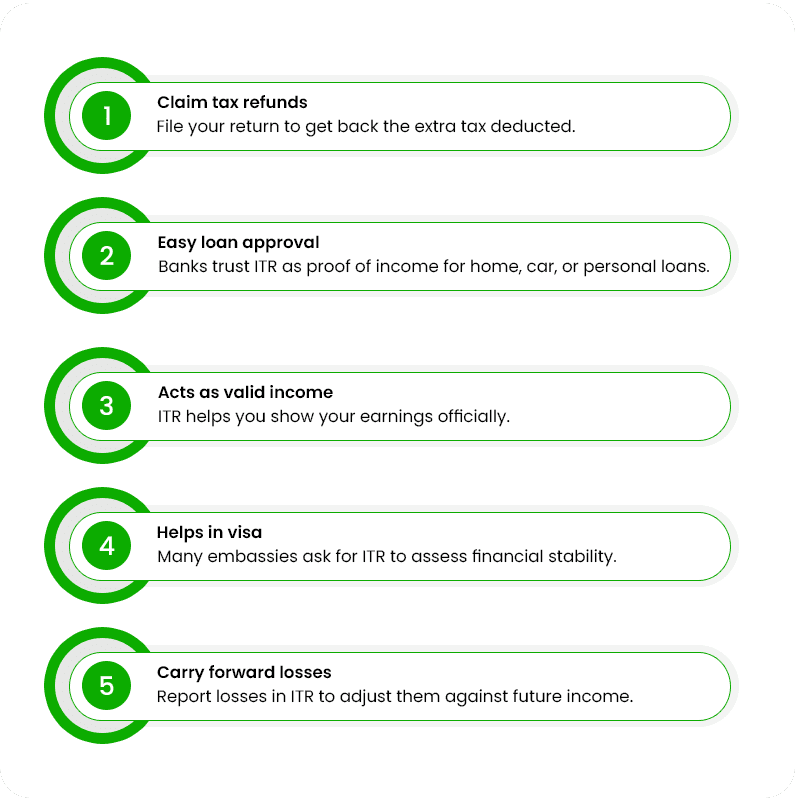

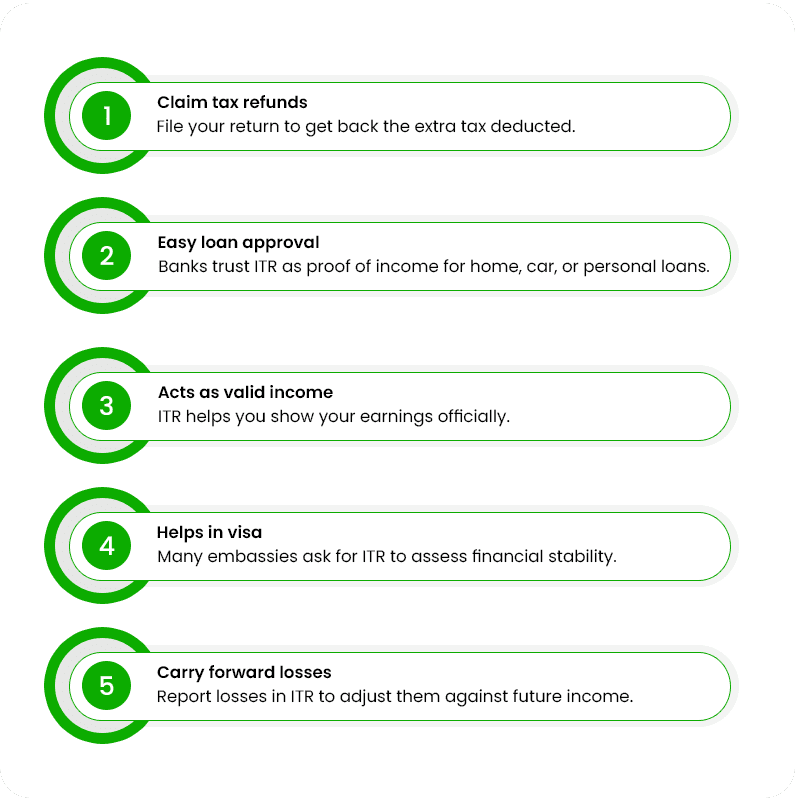

Income Tax Return Filing Benefits

There are many benefits of filing income tax, some of the major ones are as follows

1. Claim tax refunds

If your TDS has been deducted, you can easily claim your tax refund by filing income tax. Many times during a financial year, more TDS is deducted from your salary, in such a situation, by filing income tax, you can get the deducted TDS directly in your bank account. So, filing income tax return is not just a legal compliance but also an opportunity to get your extra money back.

2. Easy loan approval

Whenever a person applies for a loan from a bank, a copy of the income tax return is asked by the bank. There are many types of bank loans like car loan, home loan etc. Before issuing the loan, the bank ensures whether the person taking the loan is able to repay the loan or not. Therefore, the bank asks you for a copy of the income tax return which is considered as your income proof.

3. Faster Visa Processing

When you want to travel abroad, you need a visa. A visa is an official permission issued to enter and stay in a country. At the time of visa application, most embassies ask for a copy of your income tax return. Income tax return shows your income source and financial background. Embassies also check whether you are a stable taxpayer or not. Therefore, you are advised to file your income tax return on time.

4. Eligibility for Business and Government Tenders

Income tax return is not only a record of paying taxes, but it is also important for your business. When you apply for any government tender or big project, you have to give proof of your income, for this you can use a copy of the income tax return. This shows that you pay taxes regularly and are financially stable.

5. Carry Forward Your Losses

If you have suffered a loss in business, share market, property etc. in any year, then this loss can be adjusted with the coming years. To adjust the loss, you need to file income tax return on time. If you do not file tax on time, then you will not get this benefit.

6. Funding for New Startup

If you want to start a new business or want funding from investors to grow your business, then income tax return is considered an important document for this. Before investing in your startup, investors want to see that your income is stable, you pay taxes and your business is strong

7. Better Insurance Coverage

When you buy term insurance, insurance companies ask for a copy of your income tax return. From the income tax return, the insurance company sees how much your annual income is and what your financial situation is, whether you can pay the premium amount or not. If your annual income is high, you get more insurance coverage.

8. Proof of Income and Address

Income tax return is the official proof of your income. It helps you in applying for visa, getting credit card, bank loan etc. Your income tax return can also be used as your address proof, hence by filing tax returns regularly you can use it as address and income proof.