Union Finance Minister Nirmala Sitharaman presented the Union Budget 2026 in the Lok Sabha on 1 February, Sunday. This Budget is notable as it marks her ninth consecutive presentation, a rare milestone in the tenure of India’s finance ministers.

The Budget focuses on steady economic growth, stronger domestic finances, support for businesses, and long-term infrastructure development, while maintaining fiscal discipline in a challenging global environment.

The government has increased the capital expenditure outlay to Rs 12.2 lakh crore for FY27 from Rs 11.2 lakh crore earlier. At the same time, the fiscal deficit is expected to ease marginally to 4.3 percent of GDP. Net tax collections are projected at Rs 28.7 lakh crore, while the overall size of the Budget has been estimated at Rs 53.5 lakh crore.

Income Tax Act, 2025 to Be Notified Soon

Finance Minister Nirmala Sitharaman said that the new Income Tax Act, 2025, set to come into effect from 1 April, will be officially notified soon, with details to be shared by the government shortly.

Direct Tax Changes

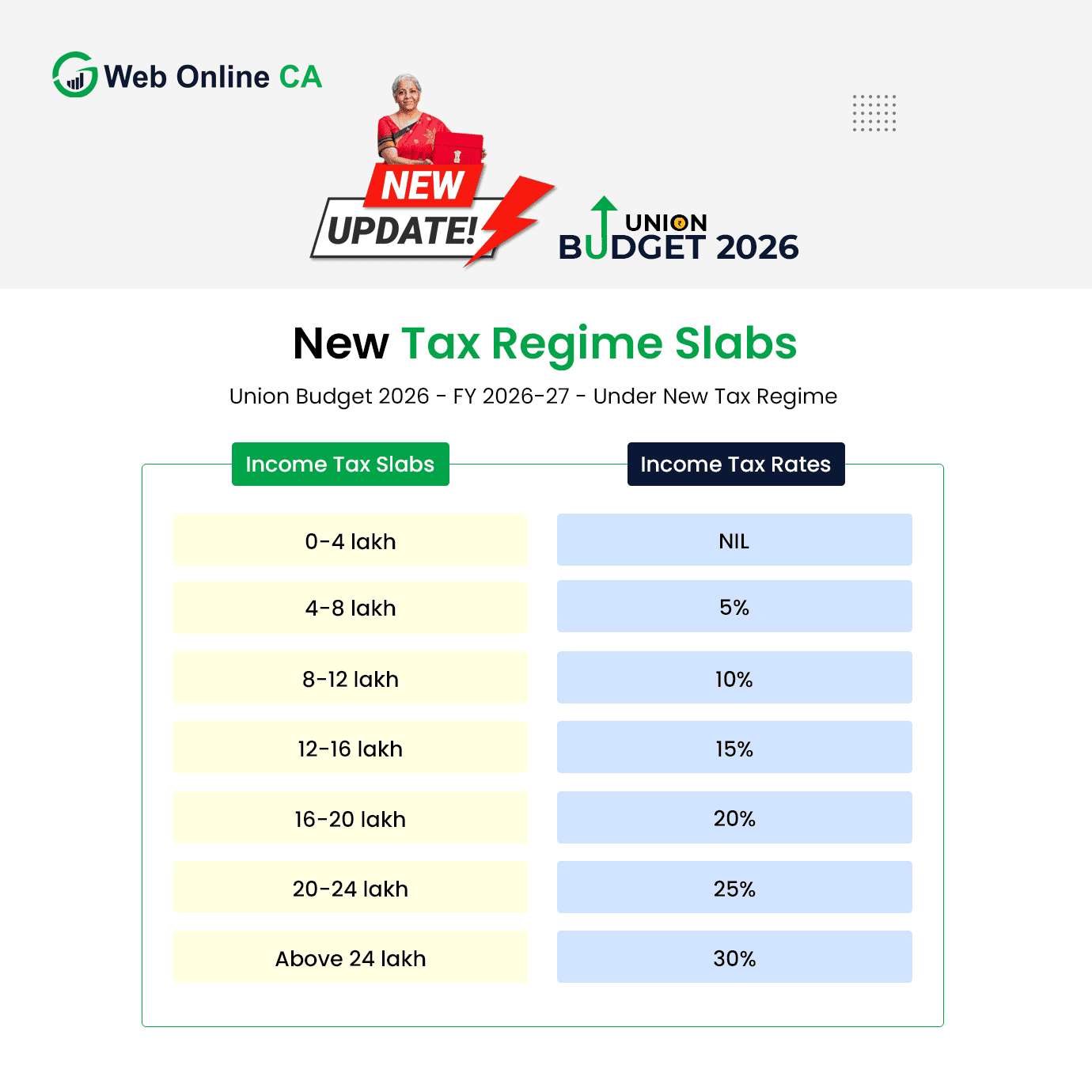

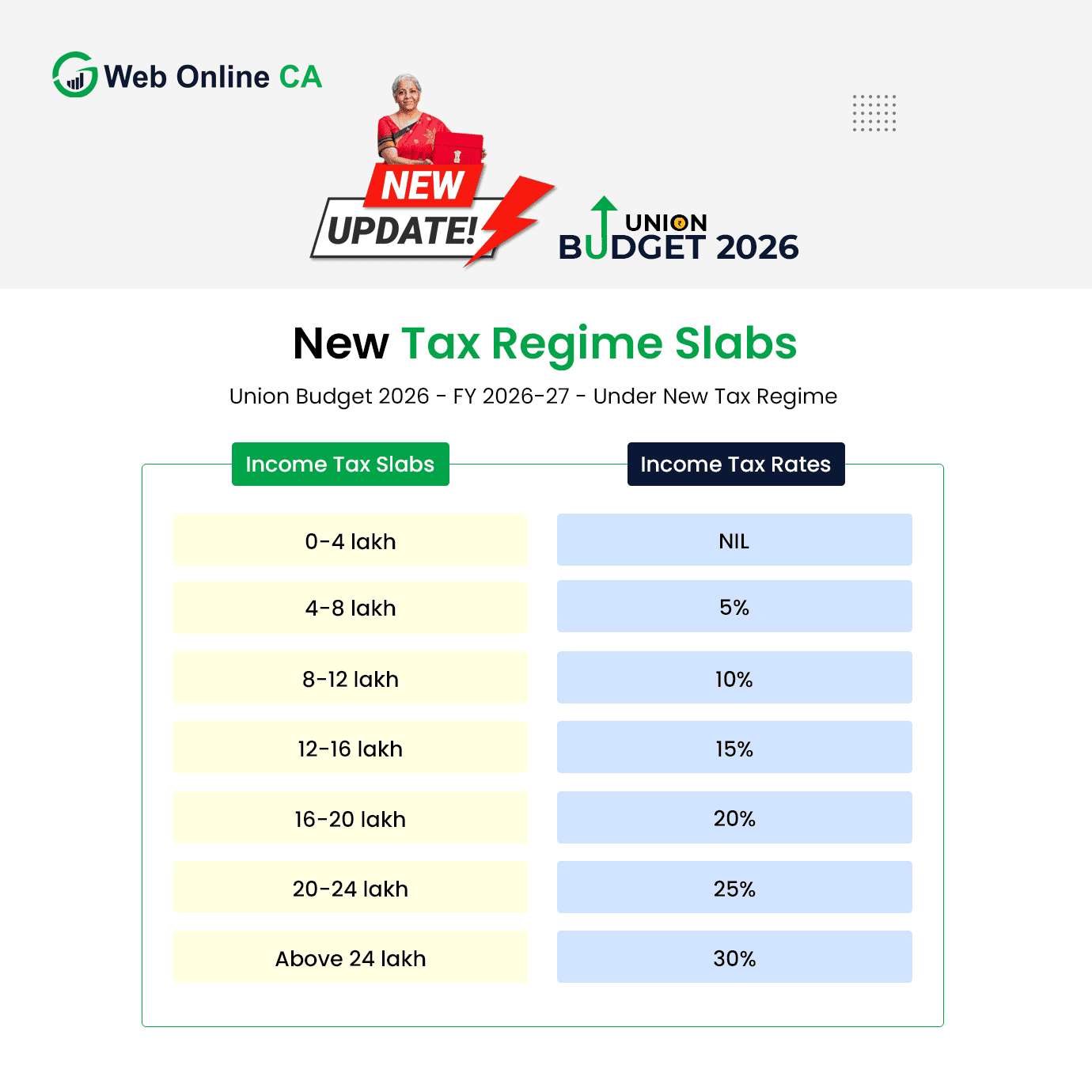

1. No change in Income Tax Slabs

Income tax rates and slabs have been kept unchanged, following the major reforms introduced last year. The Finance Minister announced measures to simplify tax compliance and provide relief to taxpayers, including an extension for revising income tax return from December 31 to March 31, with a nominal fee.

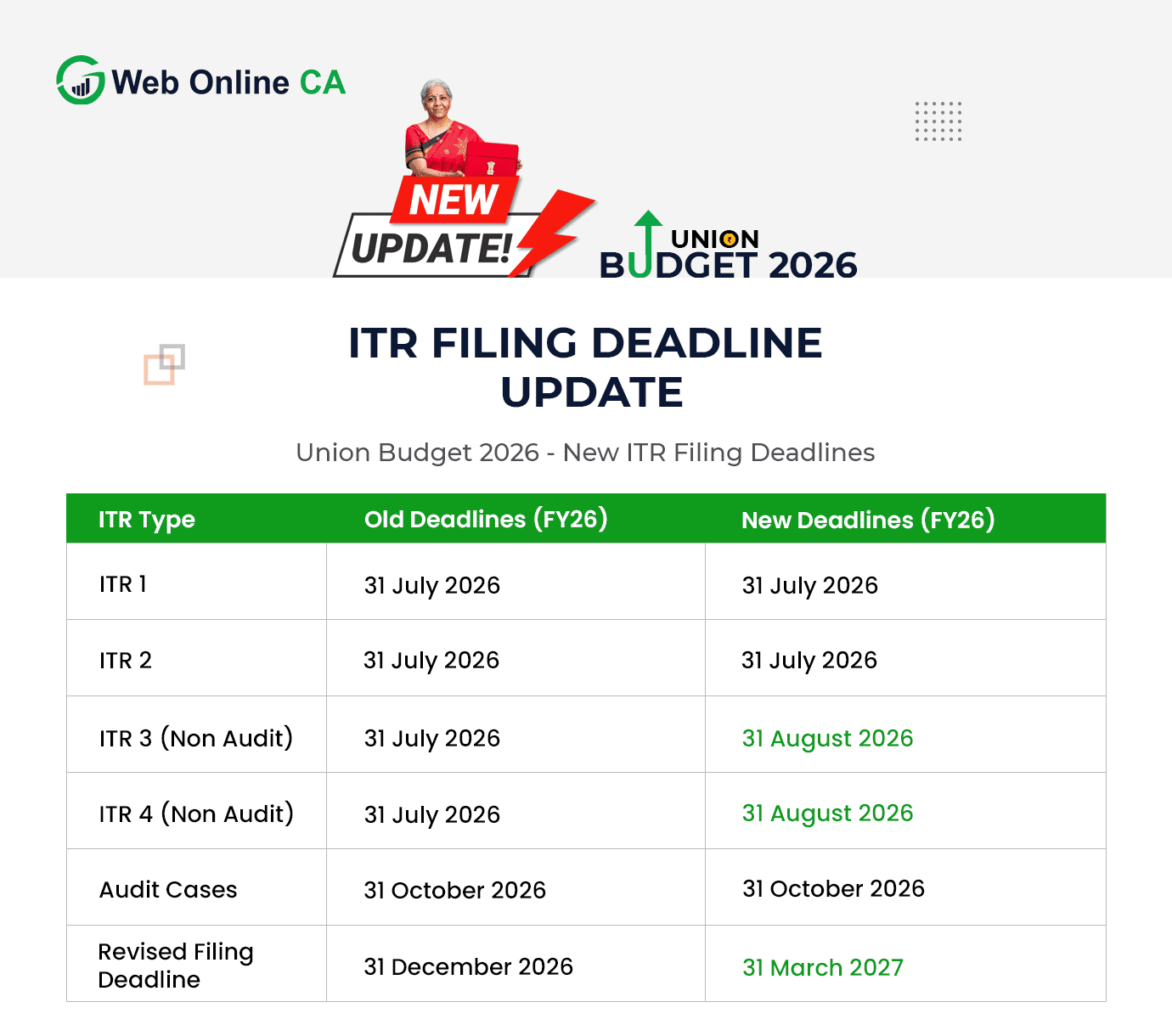

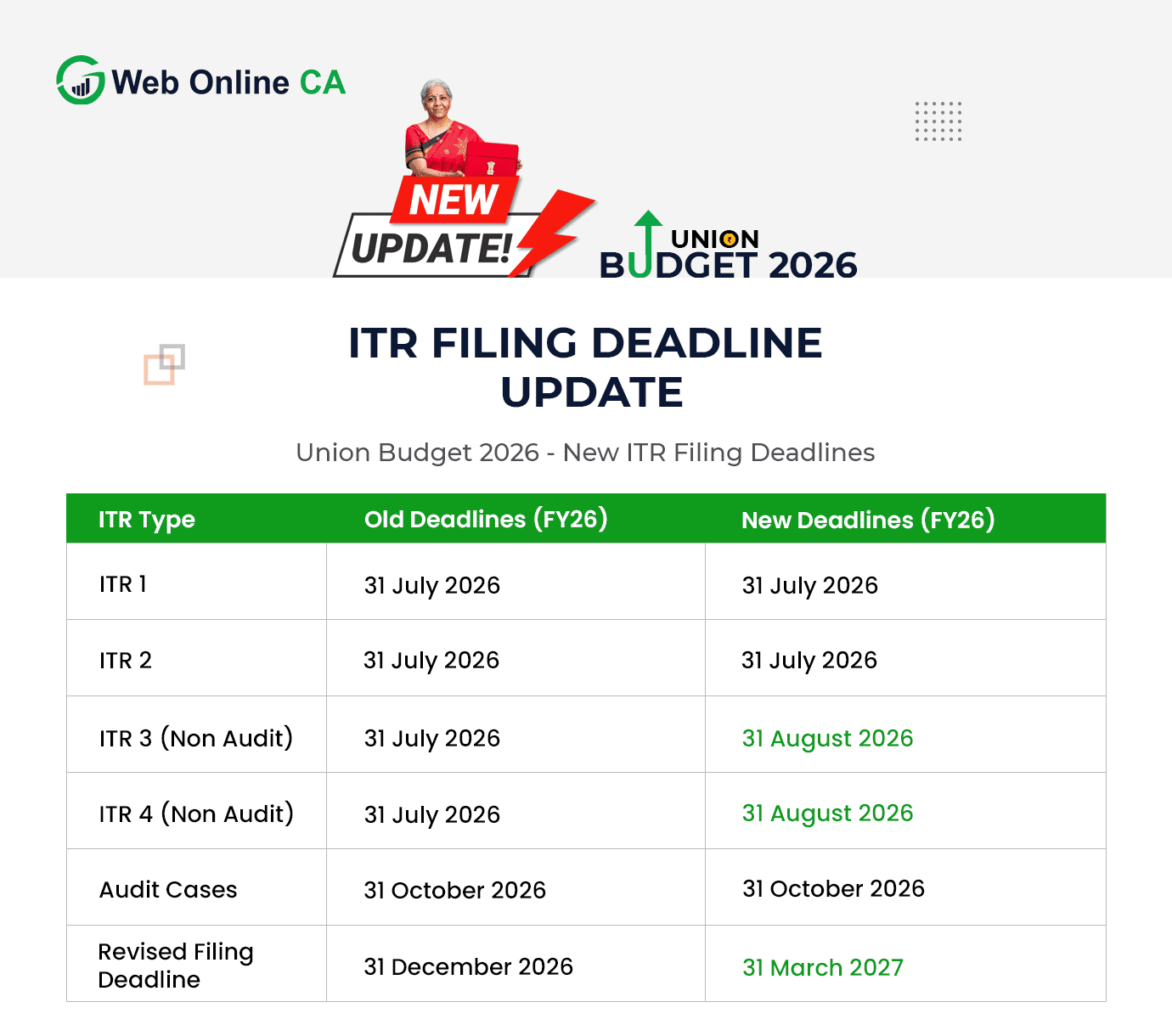

2. Extension of ITR Filing and Revised Return Deadlines

For non-audit taxpayers, except those filing ITR-1 and ITR-2, the due date for submitting income tax returns has been extended to 31st August. This extension is applicable from FY 2025-26 (AY 2026-27). Simply put, the due dates for ITR-3 and ITR-4 have now been set at 31st August. For the upcoming assessment year, eligible taxpayers must ensure their returns are filed by 31st August 2026 to remain compliant.

In addition, the Finance Ministry has extended the deadline for filing revised income tax returns. The due date, which was earlier 31st December, is now moved to 31st March. This provides taxpayers extra time to revise their returns

3. TDS & TCS Rate Changes

-

TCS on overseas tour packages reduces to 2%, helping travellers manage their expenses more smoothly.

-

TCS on education and medical payments under the LRS reduces to 2%, making it easier for families sending money abroad.

-

TDS on manpower supply services set at 1% or 2%, bringing clarity and simplifying compliance for service providers.

-

NRIs selling property in India can now deposit TDS using the buyer’s PAN instead of TAN, making the process simpler and faster.

4. Important amendments for individual taxpayers

- Interest received on compensation from the Motor Accident Claims Tribunal (MACT) is now fully tax-free, and no TDS will be deducted.

- Small taxpayers can now get lower or nil TDS certificates through an automated, rule-based system, removing the need for manual approvals.

5. Foreign Assets & NRI Tax Relief

- Small taxpayers now have a six-month window to disclose overseas income or assets, making compliance simpler.

- Individuals holding non-immovable foreign assets below ₹20 lakh get immunity from prosecution for past non-disclosure, effective from 1 October 2024, with certain conditions.

- Selected non-resident experts will have their global income exempt from tax for up to five years, encouraging international talent to work in India.

- Non-residents paying tax under presumptive schemes will now enjoy MAT exemption, reducing their tax burden.

6. TDS Procedural Changes

At present, when an NRI sells immovable property in India, the buyer is required to obtain a TAN in order to deduct TDS on the transaction.

Under the changes announced in Budget 2026, this requirement has been removed. Buyers will no longer need to apply for a TAN and can instead deposit TDS using a PAN-based challan, making the compliance process simpler and quicker.

7. Securities Transaction Tax (STT)

The new STT rates for selected securities are listed below:

| Security |

Existing STT |

Revised STT |

| Futures (sale) |

0.02% |

0.05% |

| Options (premium sale) |

0.10% |

0.15% |

| Options (exercise) |

0.13% |

0.15% |

Agriculture and Rural Economy

The Budget places strong emphasis on strengthening the rural economy through technology-led and income-focused initiatives. An AI-enabled platform, Bharat VISTAAR, has been proposed to support farmers with better advisory and decision-making tools by integrating agricultural data systems.

To improve farm incomes, new programmes will promote high-value crops such as cashew, coconut, sandalwoodand horticultural produce. The government has also reiterated its focus on allied sectors including fisheries and animal husbandry, which play a growing role in rural livelihoods.

As part of rural infrastructure development, plans have been announced for the creation of 500 new reservoirs and Amrit Sarovars, aimed at improving water availability and sustainability in villages. The Budget also encourages women-led and rural agri-entrepreneurship, supporting small businesses in agriculture and allied activities.

Tourism, Culture and Sports

- The Budget proposes new investments to improve facilities at major tourist destinations and enhance the overall visitor experience.

- Emphasis has been placed on conserving heritage sites and promoting lesser-known cultural locations.

- A long-term roadmap has been outlined to strengthen the sports ecosystem, with a focus on training facilities, talent development, and organised competitions.

MSMEs and Enterprises

- A ₹10,000 crore growth fund has been proposed to help small and medium enterprises expand operations and create jobs.

- Credit guarantee support will be provided to strengthen invoice discounting for MSMEs, improving access to working capital.

Infrastructure and Connectivity

- Faster train routes between major cities are part of the government’s push to improve long-distance travel.

- A new east-to-west freight line is planned to make the movement of goods quicker and less expensive.

- Inland waterways will be expanded further to reduce dependence on road transport.

- Infrastructure spending is set to go up to ₹12.2 lakh crore in the coming financial year.

- City-focused regions are being set up to boost local development.

Women Entrepreneurs

-

Lakhpati Didi Program will provide self-help entrepreneurs with easier access to funding and financial support.

-

She-Marts will be launched to support rural women-led enterprises, helping them expand business opportunities.

Health Sector

- Prices of medicines for seven major diseases will be reduced, and 17 medicines for diabetes and cancer will become more affordable.

- Three new Ayurveda institutes, similar in scale to AIIMS, will be set up to promote traditional healthcare.

- PM Divyang Centers will receive further support to strengthen services for specially-abled citizens.

- The Divyang Sahara Scheme will provide training and assistance to differently-abled individuals.

Key Highlights

• Income tax slabs remain unchanged, with more time allowed for filing revised returns.

• The defence budget has been increased to ₹7.85 lakh crore.

• Import duty has been removed on 17 cancer medicines and selected drugs.

• Three Ayurvedic AIIMS and five medical hubs will be set up.

• Hostels for working women and girl students will be built in around 800 districts.

• The SHE-SMART scheme has been launched to support women’s income and skills.

• Seven new high-speed rail corridors have been announced.

• Tax benefits have been increased for semiconductor and battery manufacturing.

• Special corridors will be developed for rare earth minerals.

• National Fibre Scheme and support for khadi have been announced.

• Relief in TCS has been provided on foreign spending.

• Infrastructure will be upgraded in 15,000 schools and 500 colleges.

• ₹12.2 lakh crore has been allocated for Tier-2 and Tier-3 city development.

• Interest on motor accident compensation is now tax-free.

• Tax benefits on Sovereign Gold Bonds bought from exchanges have been withdrawn.